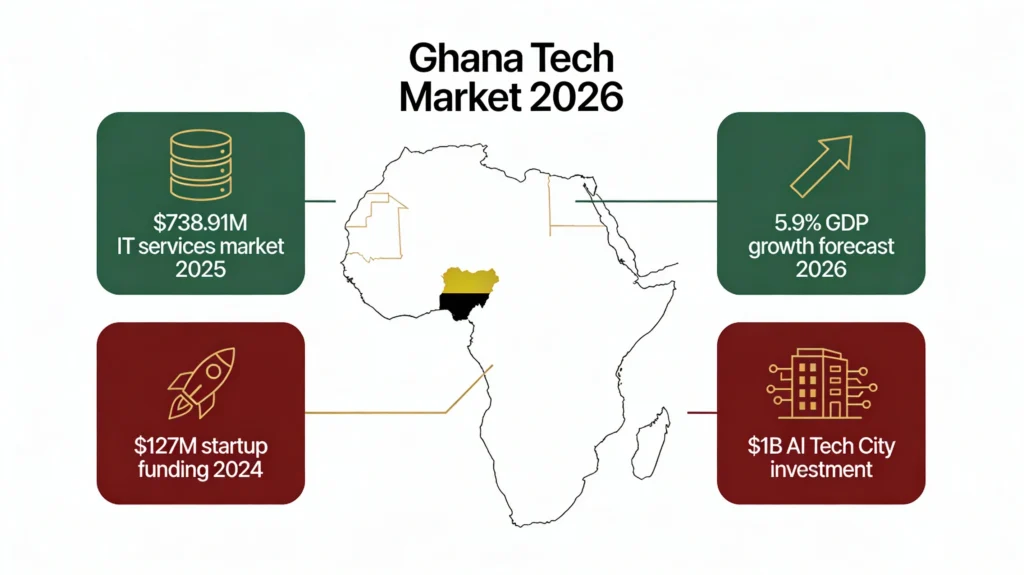

Ghana just secured a $1 billion deal with the UAE to build Africa’s largest AI hub. Construction begins in 2026 on a 25-acre site in Accra. Tech companies in Ghana aren’t just growing—they’re expanding rapidly, creating unprecedented opportunities.

The ICT sector in Ghana is transforming from a regional player into West Africa’s digital powerhouse. Startups raised $127 million in 2024, marking a staggering 95% increase. Ghana’s economic growth projections hit 5.9% for 2026. This article reveals where investors are placing bets and what it means for businesses.

Ghana’s Tech Market Snapshot: Where We Stand in 2026

The Ghana tech industry has transformed dramatically. We’re not talking about incremental gains—we’re witnessing explosive growth. Current market valuation indicates that the IT services market is attracting significant attention from global investors.

Here’s what the numbers reveal:

- Market size: $738.91M in 2025, climbing steadily

- CAGR (Compound Annual Growth Rate): 3.15% annually with acceleration expected

- Digital penetration: 68.6% of Ghanaians now access the internet

- Mobile ownership: 69.8% of the population owns smartphones

- Global ranking: Ghana sits 15th among 47 African nations in ICT development.

But let’s dig deeper into market segmentation. The digital infrastructure sector leads the charge at a $400 million valuation. Software sales command $200 million of the market. Computing market solutions account for substantial enterprise spending. Fintech, health-tech, and ed-tech bundle together at $115 million. Cybersecurity emerged at $30 million and it’s the fastest-growing subsector you’ll find.

Industry players range from established IT companies in Ghana to nimble startups. Greater Accra, Kumasi, Tema, and Takoradi host thriving tech ecosystems. The Ghana Investment Promotion Center actively courts foreign direct investment (FDI). Their efforts are paying off handsomely.

Investment Trends Reshaping Ghana’s Tech Landscape

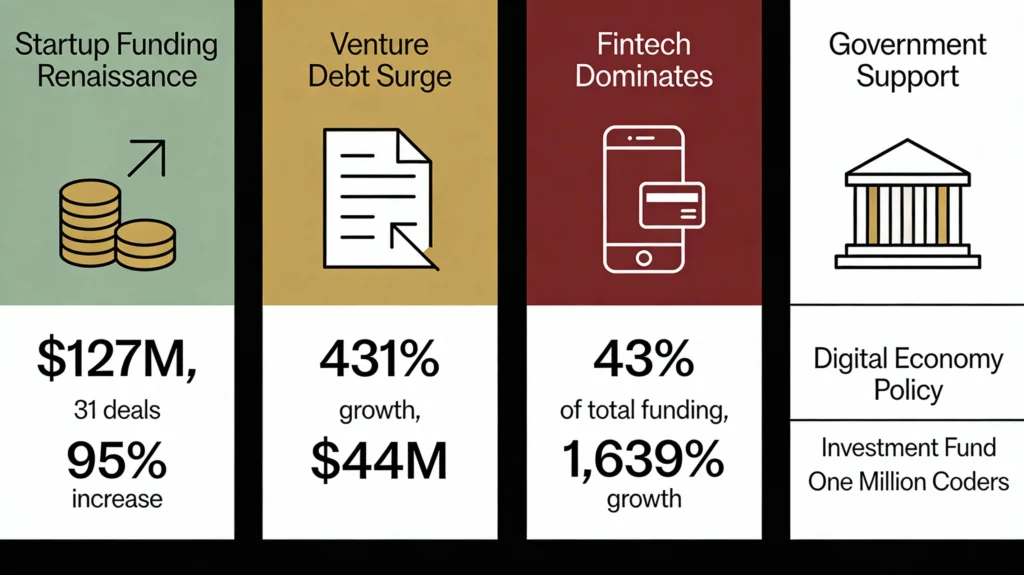

2024 marked an unexpected turning point for tech investment in Ghana. Mid-year projections suggested flat performance would continue. Then something remarkable happened in Q3 and Q4.

Startup Funding Renaissance

Ghanaian startups raised $127 million across 31 deals in 2024. That’s a 95% jump in deal volume. Venture capital activity in Ghana surged beyond anyone’s expectations. Even more striking? Venture debt exploded by 431% to reach $44 million.

Tech startups’ funding composition looked like this:

- Venture debt: $44M (alternative financing gains traction)

- Equity rounds: Captured the majority of remaining capital

- Grants: Supported early-stage innovations and R&D

This shift toward debt financing mirrors global trends. Funding opportunities diversified as traditional VC investment became more selective.

Fintech Reclaims the Crown

Fintech experienced mind-boggling financial growth of 1,639% year-over-year. The sector captured 43% of total capital inflow in 2024. Digital payment platforms dominate investor interest across Sub-Saharan Africa. Ghana historically ranks third in African fintech funding at $47M. Technology companies in Ghana in the fintech space are scaling rapidly. Mobile money penetration created fertile ground for innovation.

Emerging Sectors Gain Serious Traction

Agtech and foodtech attracted $25 million despite challenging market conditions. That resilience matters when you’re evaluating ROI (Return on Investment) potential. Health-tech solutions expanded alongside ed-tech platforms, both serving underserved markets. Cloud security valuations jumped from $500K to a projected $2.3M by 2028.

Government-backed initiatives turbocharge growth:

- Digital Economy Policy and Strategy launched with dedicated funding

- An investment fund established for the Electronic Communications infrastructure

- The One Million Coders initiative builds a talent pipeline systematically

Government digitization efforts create sustained demand for IT solutions in Ghana. Professional services and managed services benefit directly from policy momentum.

Game-Changing Projects Launching in 2026

Infrastructure investments will fundamentally reshape the investment landscape. Two landmark projects deserve your attention.

Ghana-UAE $1 Billion AI Tech City

Construction begins in 2026 on a sprawling 25-acre site. This isn’t just another development—it’s Ghana positioning itself as Africa’s AI headquarters. The facility attracts over 11,000 global tech firms Gfrom hana including Microsoft, Meta, Oracle, and IBM.

What this means practically:

- Job creation: 100,000+ positions in software development, data analysis, cybersecurity

- Talent magnet: Top ML researchers and engineers relocating to Accra

- Ecosystem catalyst: Downstream opportunities for local technology services providers

- Completion target: Fully operational by 2028

Minister George Mireku Duker called this “one of the most significant technological investments in Ghana.” He’s not exaggerating.

Google’s AI Research Centre in Accra

Google opened its first African AI lab in Accra recently. This signals Ghana’s talent quality and innovation potential clearly. Knowledge transfer accelerates when global giants establish local operations. Accra tech companies gain unprecedented access to cutting-edge research.

Subsector Explosion You Can’t Ignore

Network security market valuations jumped from $14M (2023) to a projected $26M by 2028. That’s nearly doubling in five years flat. Enterprise IT spending continues climbing as businesses digitize operations. National fiber network backbone expansion removes infrastructure bottlenecks. Market expansion creates opportunities across the entire value chain.

What This Means for Businesses in Ghana

Economic growth in Ghana accelerates to 5.9% GDP growth forecast for 2026. Real GDP slightly exceeds 2025’s 5.8% performance. This sector expansion directly impacts tech companies in Ghana and their clients.

Business opportunities emerging right now:

- B2B technology services demand skyrockets with government digitization push

- SMEs desperately need IT solutions for infrastructure, cybersecurity, and cloud migration

- Government contracts open through systematic digitization initiatives

- Talent availability improves dramatically via the One Million Coders program

- West Africa tech hub positioning attracts regional clients to Ghanaian providers

Local information technology providers offer distinct advantages over international competitors. Cost efficiency matters enormously for budget-conscious SMEs. Geographic proximity enables responsive business IT support. Market understanding helps tailor solutions to local business contexts.

The 31 startups that raised funding need operational efficiency now. They’re actively seeking network solutions, IT support services, and cybersecurity partnerships. Market penetration strategies favor established local players with proven track records.

Navigating the Growing Pains

Let’s address market challenges honestly. Ghana still lags Kenya’s $638M and Nigeria’s $410M in startup funding. Market restraints persist despite impressive growth trajectories. Currency depreciation affects operational costs for technology companies in Ghana.

Growth drivers face these headwinds:

- Infrastructure gaps remain pronounced outside Greater Accra

- Talent retention challenges intensify with international recruitment

- Regulatory frameworks continue to mature and evolve

- Access to patient capital remains limited for early-stage ventures

Acknowledging these realities builds credibility. Industry outlook remains overwhelmingly positive despite obstacles. Market forecast 2026 projections account for both opportunities and constraints. The competitive landscape rewards providers who navigate challenges strategically.